Current Trends in Scope 3 Disclosure Rates

Reporting on Scope 3 greenhouse gas (GHG) emissions remains a complex undertaking for companies, requiring calculation, estimation, and assumptions – particularly concerning factors outside of direct operational control. However, significant progress has been observed in recent years in the quality and prevalence of Scope 3 disclosures, especially amongst larger, more mature organizations.

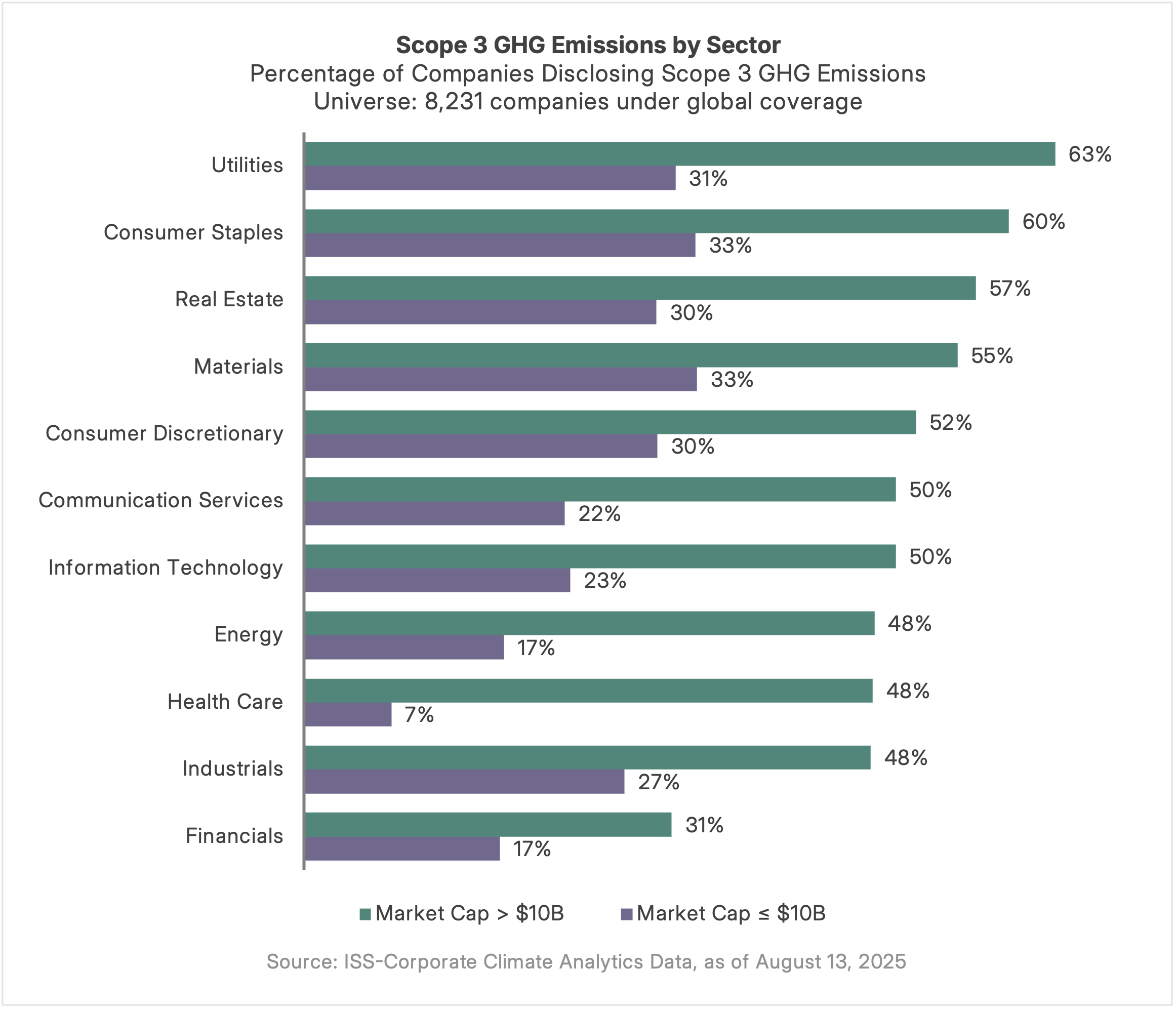

Currently, approximately 29% of the 8,231 publicly traded companies in ISS’s global coverage report Scope 3 emissions; this figure rises to 48% for large-cap firms (market cap exceeding $10 billion). As illustrated below, Scope 3 disclosure rates vary considerably by sector, with Utilities, Consumer Staples, and Real Estate leading the way.

Scope 3 Emissions: Disclosure Trends and Sector Insights

These growing disclosures are beginning to illuminate the materiality of specific Scope 3 GHG emission categories. Following the GHG Protocol, emissions are categorized into 15 distinct areas representing key business activities. ISS-Corporate recently analyzed disclosures from 2,394 companies reporting Scope 3 emissions to determine the prevalence of these categories.

The resulting analysis, presented in the table below, reveals substantial sector-specific variation in the primary sources of Scope 3 emissions. Notably, Purchased Goods and Services (Category 1) and Use of Sold Products (Category 11) consistently represent a significant portion of reported Scope 3 emissions across many sectors. However, sector-specific factors drive materiality – such as Investments (Category 15) for Financials, Fuel & Energy Activities (Category 3) for Utilities, and Downstream Leased Assets (Category 13) for Real Estate.

Source: ISS-Corporate Climate Analytics Data, as of August 13, 2025

Scope 3 Categories Descriptions: 1 – Purchased Goods and Services | 2 – Capital Goods | 3 – Fuel & Energy Activities | 4 – Upstream Transportation & Distribution | 5 – Waste | 6 – Business Travel | 7 – Employee Commuting | 8 – Upstream Leased Assets | 9 – Downstream Transportation & Distribution | 10 – Processing of Sold Products | 11 – Use of Sold Product | 12 – End-of-Life Treatment | 13 – Downstream Leased Assets | 14 – Franchises | 15 – Investments

As Scope 3 reporting becomes more standardized, externally assured, and comprehensive, this data will become an increasingly valuable resource. Companies can leverage this information for benchmarking, materiality assessments, and ultimately, the development of effective emissions reduction strategies. Enhanced transparency in this area is anticipated to drive corporate action, inform investment decisions, and accelerate the transition to a low-carbon economy.

Climate Action 100+: Trends and Expectations for 2026

EU Sustainability Rules Reset: What the 2026 Changes Mean

Science-Based Targets: Evolving Standards and Global Adoption

Latin America’s Sustainability Reporting Gains Momentum

Rare Earth Minerals: The Hidden Backbone of the Energy Transition

California Climate Laws Update: CARB Workshop and SB 261 Pause

Energy Management Systems: Global Trends and Best Practices

2025 Sustainability Reporting: Global Trends in Framework Adoption

Getting Materiality Right: Challenges, Risks, and Best Practices

Spain Introduces Mandatory Climate Disclosure