A consultative and independent approach to 15(c) reporting and benchmarking

Over two decades of 15(c) reporting experience combining data, nuanced perspective, and a robust independent methodology for peer selection

We specialize in the 15(c) contract review process, acting solely on behalf of the Funds and the Board.

Our consistently applied methodologies and transparent communication with Fund Management and Boards of Directors ensure the highest level of integrity and allow you to focus on strategic fund oversight.

How we help

Obtain independent analysis to meet 15(c) obligations

- Simplify the 15(c) contract renewal process and strengthen fiduciary oversight

- Enable fund trustees or directors to access market data for due diligence

- Benefit from efficient, cost-effective production of customized 15(c) reports

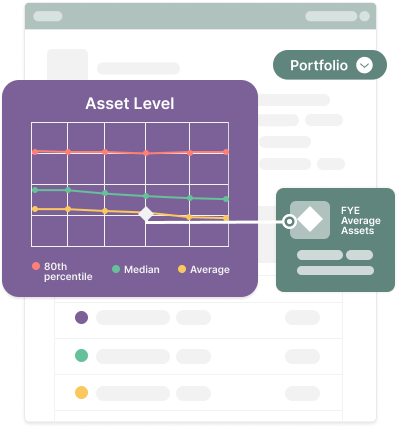

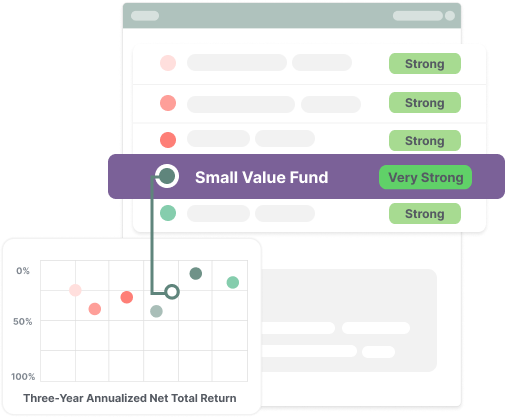

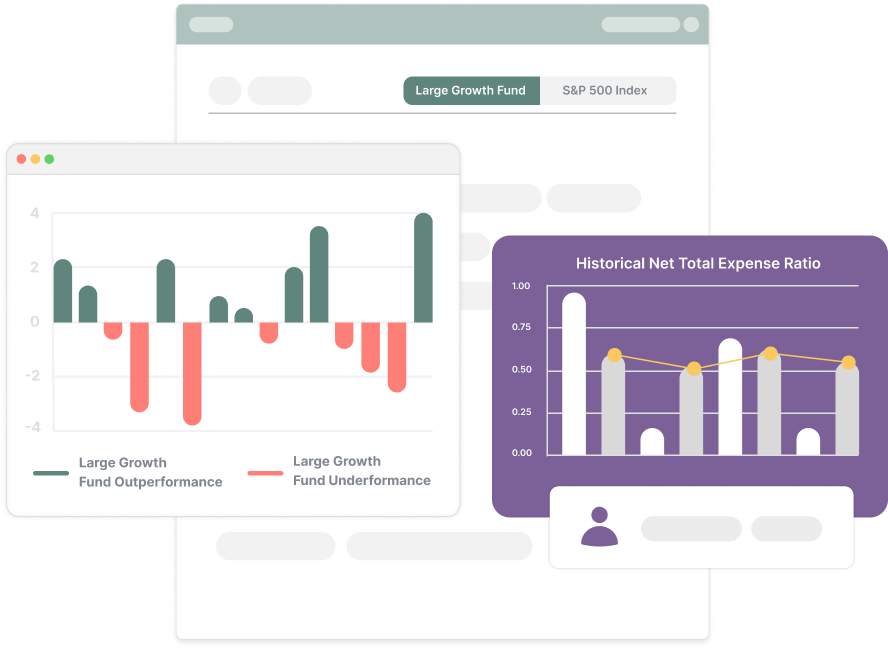

Leverage comprehensive peer benchmarking intelligence

- Get clear, data-driven comparisons of your fund’s expenses and performance —based on peer groups that align with your investment strategy

- Understand broader industry trends around fund fees, expenses, and profitability

- Obtain consultative focus for unique or esoteric fund types while employing a robust independent methodology for peer selection

Benefit from experienced guidance and dedicated support

- Our senior analysts join board meetings to share insights on reports and industry trends

- Receive customized presentations tailored to your board’s specific needs and priorities

- Stay ahead of the curve with comprehensive research — our research team continuously engages with clients to identify emerging trends and deliver insightful analysis

Experience you can trust

and board reporting expertise

Fulfill fiduciary duties with consultative reporting and trusted benchmarking on fund fees, expenses, and performance.

Our rigorous approach

Our US-based research team combines decades of industry experience covering share class pricing and distribution strategy with a commitment to accuracy and transparency. We:

- Monitor the market: Our data team reviews filings daily, ensuring our database represents the most accurate and timely data.

- Lead with expertise: Our principals consult with both the industry’s largest and smallest investment companies and present at many board meetings and industry events every year, staying at the forefront of best practices.

- Deliver in-depth research: We publish several annual research reports on mutual fund industry fee and expense benchmarking, providing boards with independent insights and valuable intelligence.

Explore the latest trends and practices in corporate governance

Navigating Governance Trends and the Proxy Landscape for Companies in EMEA

Navigating Canadian Corporate Governance and Proxy Trends for 2026

Navigating U.S. Corporate Governance Trends and Proxy Landscape for 2026

New Approach to SEC Rule 14a-8: What It Means for Companies

Governance, Risk & Resilience: Key Takeaways from London

U.K. 2025 AGM Season Review: Focus on Executive Pay Sharpens Amid New Guidance

Request a Sample Report

Discuss 15(c) reporting needs with our team.