Global Interest in ISSB Standards Rises Amid EU Uncertainty

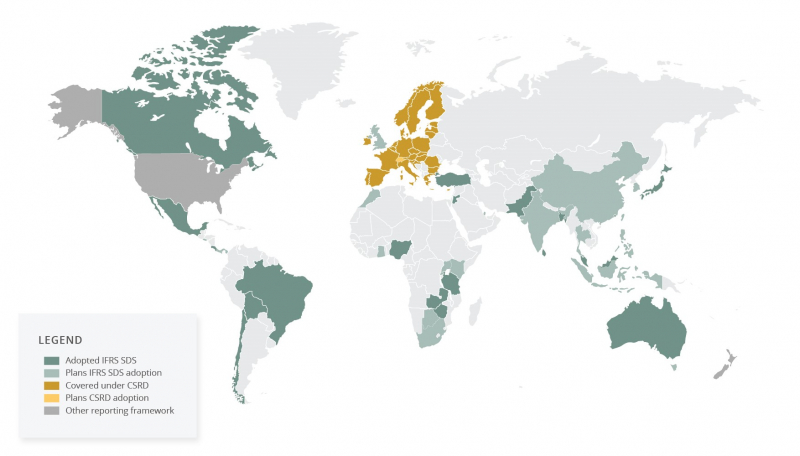

Twenty countries have adopted the International Sustainability Standards Board (ISSB) International Financial Reporting Standards (IFRS) S1 and S2 into their jurisdictional reporting frameworks. A similar number of countries are also undergoing consultation to finalize ISSB adoption roadmaps for sustainability reporting. According to ISSB Chair Emmanuel Faber, jurisdictions progressing toward ISSB adoption collectively represent over 60% of total global GDP.

ISSB and CSRD Adoption

The global adoption of the IFRS Sustainability Disclosure Standards (SDS) takes on added significance amid the EU’s proposed Omnibus package, which is expected to scale back the scope of the Corporate Sustainability Reporting Directive (CSRD).

The IFRS SDS are built on the four pillars of the Taskforce on Climate-Related Financial Disclosures (TCFD) – governance, strategy, risk management, metrics and targets. The framework currently includes two standards: IFRS S1 – General Requirements for Disclosure of Sustainability-related Financial Information – and IFRS S2 – Climate-related Disclosures. Three key concepts underpin both standards, guiding how entities should prepare, evaluate, and report sustainability information. These are:

- Financial materiality – information is material if omitting, misstating, or obscuring it could reasonably be expected to influence the decisions of the primary users of general-purpose financial reporting.

- Connectivity – sustainability-related financial disclosures should connect directly to an entity’s financial statements.

- Proportionality – entities should use all reasonable and supportable information that is available at the reporting date without undue cost of effort, where reporting should be commensurate with the skills, capabilities, and resources that are available to the company.

Central to the standards are the needs of existing and potential investors, with a focus on sustainability-related risks and opportunities that could reasonably be expected to affect the cash flow, access to finance, or cost of capital for an entity. In 2023, the International Organization of Securities Commissions (IOSCO) endorsed the inaugural standards, reinforcing their credibility. This endorsement, along with the flexibility for jurisdictions to adopt the standards in phases, has led several national securities regulators to move forward with implementation. As the ISSB looks to establish a global baseline for sustainability disclosures, adoption continues to expand across jurisdictions.

Uptake continues to grow in 2025

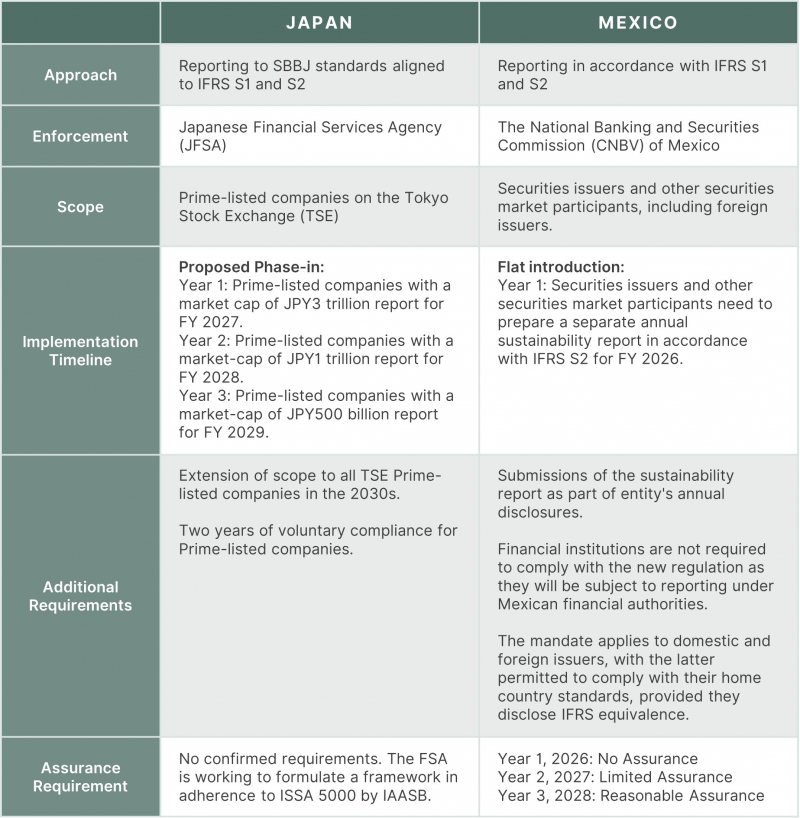

So far in 2025, both Japan and Mexico have formally adopted the standards as part of each country’s approach to implementing mandatory sustainability reporting requirements for issuers. While both countries have chosen to align to ISSB standards to enhance transparent sustainability disclosure for market participants, the requirements diverge on key details relating to scope, the application of the standards and timelines for reporting.

Adoption comes in different styles

In Japan, the Japanese Sustainability Disclosure Standards have been drafted by the Sustainability Standards Board of Japan (SSBJ) aligned to IFRS S1 and S2. In Mexico, the Mexican Banking and Securities Commission (CNBV) has published a resolution amending the general provisions applicable to issuers of securities and other market participants, with requirements to report sustainability information in accordance with IFRS S1 and S2. This is in addition to the requirements for private Mexican companies that report financial statements under the Mexican Financial Reporting Standards, that are required to report sustainability information in their financial footnotes for fiscal years on or after January 1, 2025.

The SSBJ Standards are comprised of three components – The Application Standard, which relates to the basic requirements for sustainability reporting, as in IFRS S1; The General Standard, which relates to sustainability-related risks and opportunities, as in IFRS S1; and The Climate Standard, which relates to climate-related disclosures, as in IFRS S2. The first wave of listed companies is anticipated to have to report to these new standards for the financial year ending March 2027.

Under regulation in Mexico, covered entities will need to report information on governance, strategy, and risk and opportunity management related to sustainability, as well as metrics and targets aligned with IFRS S1 and IFRS S2, in a separate report. Both domestic and foreign issuers are required to disclose sustainability information aligned to IFRS SDS in 2026, with assurance requirements introduced in 2027 on a limited assurance basis.

Existing adopters kick off the first reporting cycles

There are also several jurisdictions, in which reporting requirements have already commenced. Mandatory reporting is underway for companies covered by ISSB-aligned reporting in Australia, Costa Rica, Malaysia, Sri Lanka, Tanzania, and Pakistan later this year. For issuers on the Hong Kong Stock Exchange, reporting as of January 2025 is on a ‘comply or explain’ basis, with mandatory reporting to follow based on IFRS S2, from 2026 onwards. Despite the walk-back of mandatory ISSB-aligned reporting in Canada by the Canadian Securities Administrators (CSA), it is also likely that Canadian firms will utilize the Canadian Sustainability Disclosure Standards (CSDS) on a voluntary basis.

The rate of adoption and implementation over the coming two years should signal to large, listed organisations, that despite certain headwinds in the sustainability regulatory environment, the approval of a globally comparable standard for non-financial information continues to grow, and organisations still need to prepare.

ISSB continues to develop and iterate

Given the extensive and evolving landscape of global adoption, the ISSB is continuing to support the implementation of IFRS S1 and S2 through educational materials, stakeholder events, and collaboration through IOSCO’s Growth and Emerging Markets Committee network. Additionally, efforts are underway to enhance the SASB Standards, starting with extractives, minerals processing, and infrastructure sectors, with exposure drafts anticipated in the second quarter of 2025.

In addition to these ongoing workstreams, the ISSB is exploring the development of new standards beyond climate, focusing on biodiversity and human capital. As these efforts progress, ISS-Corporate will continue to track key developments.

Climate Action 100+: Trends and Expectations for 2026

EU Sustainability Rules Reset: What the 2026 Changes Mean

Science-Based Targets: Evolving Standards and Global Adoption

Latin America’s Sustainability Reporting Gains Momentum

Rare Earth Minerals: The Hidden Backbone of the Energy Transition

California Climate Laws Update: CARB Workshop and SB 261 Pause

Energy Management Systems: Global Trends and Best Practices

2025 Sustainability Reporting: Global Trends in Framework Adoption

Getting Materiality Right: Challenges, Risks, and Best Practices

Spain Introduces Mandatory Climate Disclosure