DATE PUBLISHED: March 8, 2024

SEC Adopts Climate Disclosure Rule: Key Takeaways for Corporates

On Wednesday, March 6, the U.S. Securities and Exchange Commission (SEC) approved a rule that will require climate-related disclosures for many public companies.

The SEC’s climate rule mandates certain standardized climate-related disclosures from registrants, many of which depend on a “materiality” assessment. The final rule contains several substantive changes from the proposed rule, which was first released almost two years ago. Some of the high-profile changes include the removal of all requirements pertaining to Scope 3 emission reporting, the narrowing of Scopes 1 & 2 disclosure requirements to only larger registrants and only when material, the narrowing of several prescriptive board- and management-related climate oversight disclosures, and the removal of certain line-item disclosure requirements.

Key Disclosure Requirements

The final rule includes the following key requirements:

- Disclosure of climate-related information relating to governance, strategy, and risk management (largely maintained from initial proposal).

- This mandate includes reporting requirements on any oversight by the board of directors on climate risk, and the role by management in managing material climate risk. The final rule eliminates the proposed requirement to disclose whether any board member has expertise in climate-related risks and the nature of the expertise. The rule maintains, however, the requirement to identify any board committee or subcommittee responsible for the oversight of climate-related risks, if a registrant has such a committee or subcommittee, and the requirement to describe the processes by which the board or any board committee or subcommittee is informed about climate-related risk.

- This part of the rule also includes the requirement to describe the potential or actual impact of climate risks on business operations, products or services, suppliers (to the extent known or reasonably available), expenditure for research and development, and other business considerations.

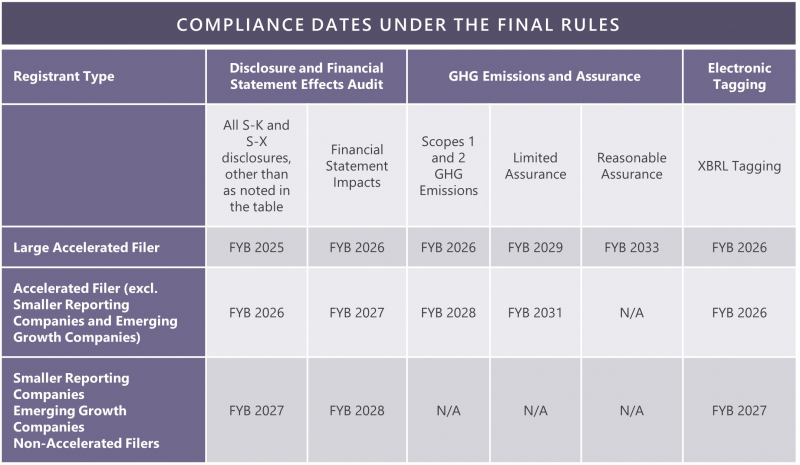

- Scope 1 and/or Scope 2 disclosures for larger registrants when material (there are broad exemptions on GHG reporting for smaller and emerging growth companies), starting FYB[1] 2026.

- On-ramp for independent assurance of GHG emissions reporting; at first, limited assurance, starting with FYB 2029; followed by reasonable assurance (only for large, accelerated filers), starting FYB 2033.

- An accommodation for the delayed reporting of Scopes 1 and 2 emissions (reporting during the second quarter of the fiscal year following the reported period).

- Disclosure of “financial statement effects of severe weather events and other natural conditions” in a note to the financial statements (still subject to the initially proposed 1% threshold). Line-item disclosures on expenditures on transition activities have been removed.

- De minimis thresholds: (1) $100,000 for expenditures expensed as incurred and losses in the income statement, and (2) $500,000 for capitalized costs and charges recognized on the balance sheet.

- The final rule provides an expanded safe harbor for private liability to cover disclosures “pertaining to transition plans, scenario analysis, the use of an internal carbon price, and targets and goals.”

- Disclosures on transition-related expenditures are no longer required; but, if a “material component of a registrant’s plans to achieve its disclosed climate-related targets or goals,” then “capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates” must be disclosed in a note to financial statements.

Disclosure Timelines

The table below outlines the updated compliance timelines.

Source: SEC Fact Sheet on The Enhancements and Standardization of Climate-Related Disclosures: Final Rules

Current U.S. Corporate Disclosures

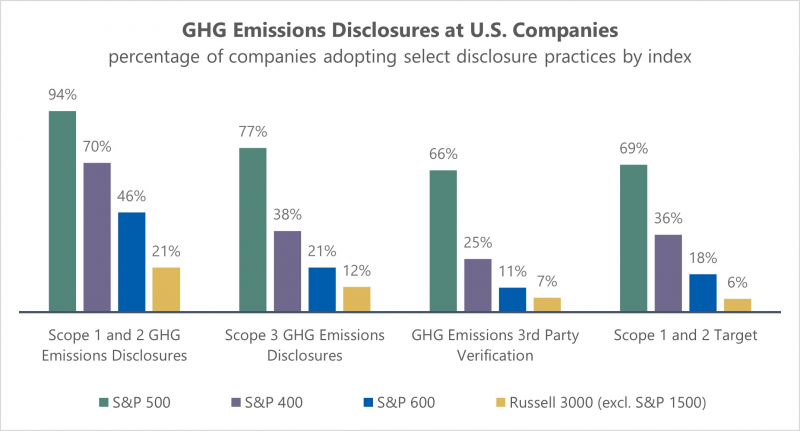

U.S. companies may have some ground to cover as it relates to the requirements for Scope 1 and Scope 2 GHG emissions and assurance requirements on GHG emissions disclosures. According to media reports,[2] the SEC estimates that approximately 2,800 companies will be required to disclose under the new requirements. According to ISS-Corporate data, approximately 45% of Russell 3000 companies presently report Scope 1 and Scope 2 GHG emissions, with disclosure levels significantly lower among smaller-sized firms. Only 20% of Russell 3000 currently demonstrate third party verification on their GHG emissions disclosures. Excluding S&P 500 companies only about 11% of the remaining Russell 3000 constituents currently provide third-party verification.

Source: ISS-Corporate ESG Data, as of February 29, 2024

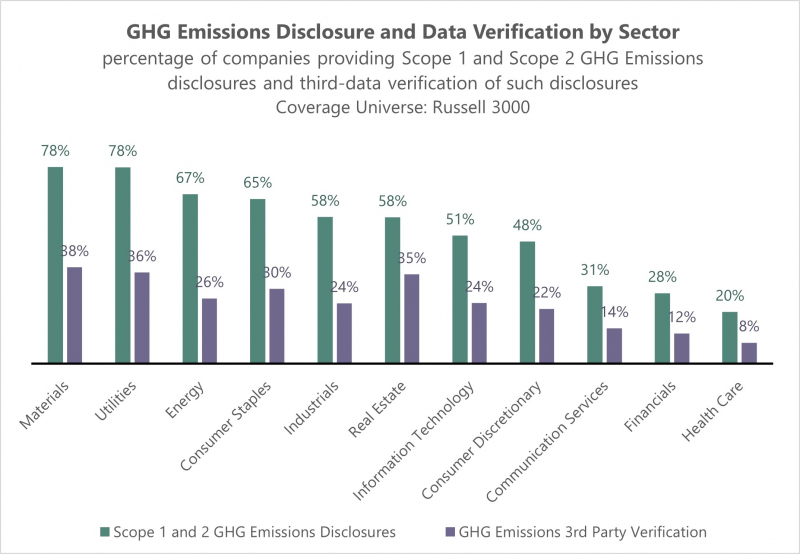

Disclosure readiness may vary by sector, as one observes significant variation from industry to industry. Based on ISS-Corporate data for Russell 3000 companies, the Materials, Utilities, and Energy sectors appear to lead in prevalence of disclosures of Scope 1 and Scope 2 GHG emissions, while Communications Services, Financials, and Health Care appear to demonstrate the lowest levels of emissions reporting. The variation by industry may potentially serve as an indication of which sectors may end up identifying these disclosures as more material, since Scope 1 and Scope 2 emissions reporting will be subject to a materiality assessment by companies.

Source: ISS-Corporate ESG Data, as of February 29, 2024

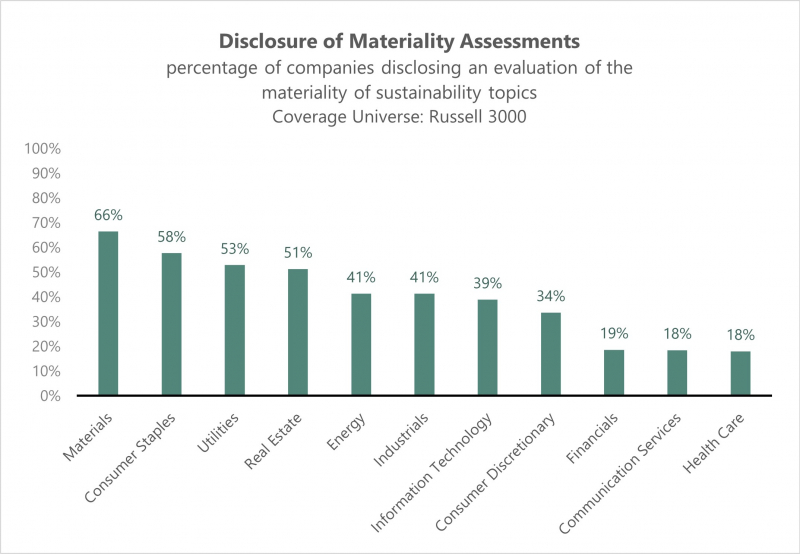

The materiality assessment requirement in relation to elements of the SEC climate rule, including Scope 1 and Scope 2 emissions disclosure, may not specifically require a comprehensive materiality assessment for all sustainability topics. However, this condition could prompt companies to conduct a materiality assessment for the purposes of strategy development and better management of their sustainability programs. The conduct of periodic materiality assessments is considered best practice among sustainability professionals. The recently issued European Union Corporate Sustainability Reporting Directive (CSRD) requires the implementation of materiality assessments following the double materiality principle (considering both financial materiality and impacts to environment and society) along the value chain.

Currently only one-third of Russell 3000 companies disclose their evaluation of material topics as part of their sustainability disclosures. As observed with GHG emissions disclosures, there is also significant variation on materiality assessment disclosure by company size and by sector, with smaller companies providing such disclosures at a much lower rate. Financials, Communication Services, and Health Care companies tend to display the lowest levels of disclosure in this area, with less than 20% of companies providing such information. Materials, Consumer Staples, Utilities, and Real Estate appear to lead other sectors, with a majority of companies sharing materiality assessments in their disclosures in each of these sectors.

Source: ISS-Corporate ESG Data, as of February 29, 2024

While the fate of the rule may remain uncertain, pending legal challenges and the outcome of the 2024 U.S. general election, U.S. companies will need to take action to meet the new requirements, which also align with several other mandates that may impact many U.S. firms including the California bills on climate reporting and the EU CSRD. As investor and market expectations as well as regulatory requirements on climate reporting continue to increase, companies will be best served assessing their level of preparedness to meet the new standards.

Notes:

[1] FYB refers to any fiscal year beginning in the calendar year mentioned.

[2] SEC approves rule requiring some companies to report greenhouse gas emissions, Associated Press, March 6, 2024