Sustainability Solutions

The Complete Picture in ESG Disclosure and Performance

SPOTLIGHT

ISS-Corporate Acquires Sustainability Reporting Software Provider, Celsia

Empowering Proactive Sustainability Management

In a complex environment of evolving sustainability practices, a multitude of ESG ratings, shareholder pressures, and regulatory requirements, ISS-Corporate supports companies across industries in developing strategic and targeted approaches to sustainability management and reporting.

ISS-Corporate licenses and applies the SASB Standards in our work.

FEATURING

The ISS ESG Gateway

Access a range of high-level ISS ESG corporate ratings, scores, and fund ratings.

Where does your company stack up?

ISS-Corporate helps you benchmark your responsible investment risk and uncover opportunities to maximize your appeal to investors.

- Transparent methodology

- Quantitative and qualitative data informed by the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD)

- An annual methodology review ensures data continuously stays in step with disclosure standards

- Data verification online and accessible to issuers year-round

EXPLORE ISS-CORPORATE ESG SOLUTIONS

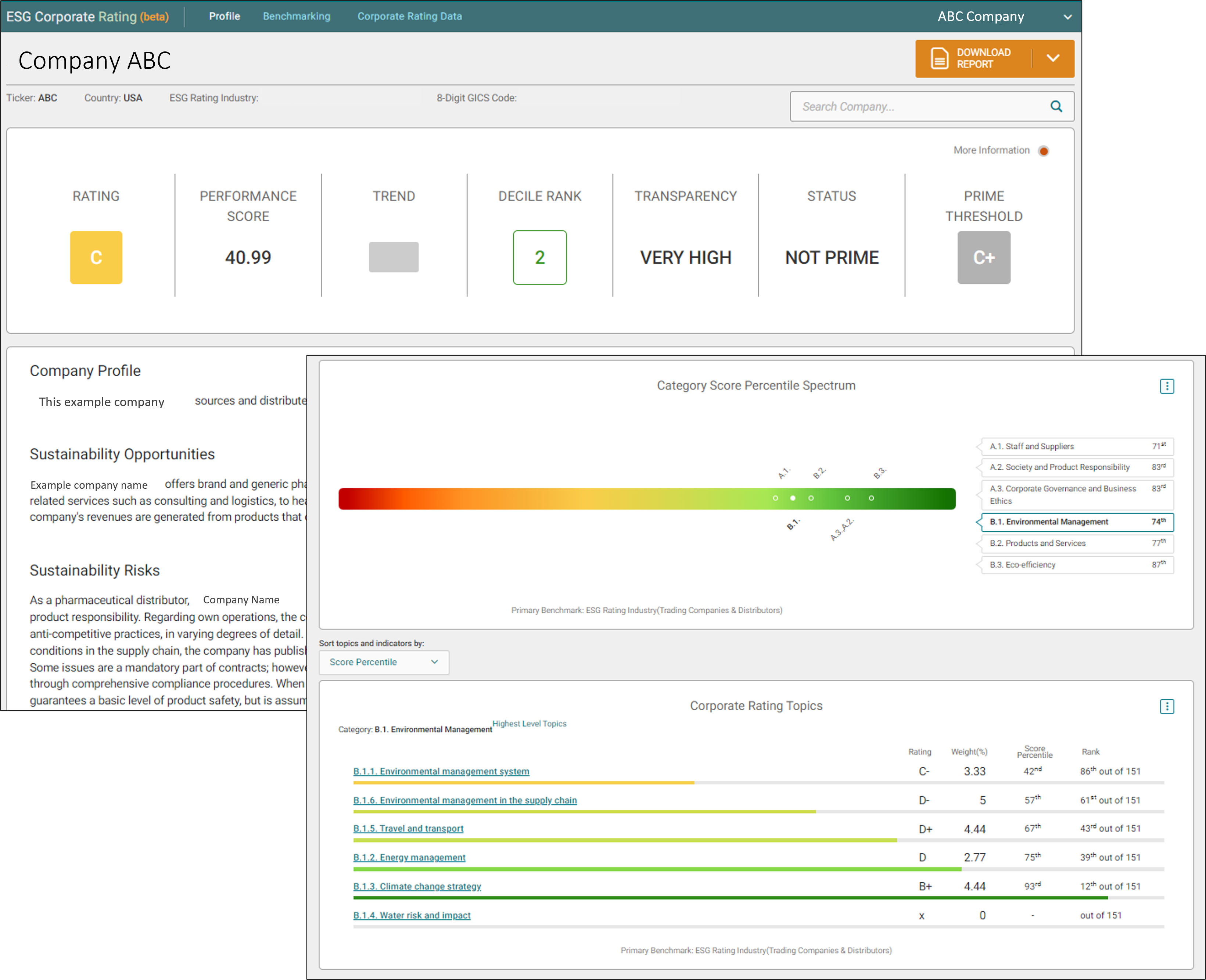

ESG CORPORATE RATING

- Benchmark ratings and performance against peers to identify industry best practices and improvement opportunities for sustainability management program.

- Derive actionable insights on opportunities to improve sustainability performance and associated disclosures based on indicator evaluation approaches and analyst assessments.

- Build a business case for internal support on priority initiatives leveraging powerful benchmarking comparisons and executive- and board-ready automated reporting capabilities.

- Access unprecedented ESG performance data for more than 7,500 companies in the coverage universe

E&S QUALITYSCORE TOOLS

Understand how investors perceive your sustainability program, prioritize disclosure changes based on what matters to investors, and stay ahead of shifts in sustainability norms.

Get an overview of the E&S QualityScore methodology & summary of key issues.

REQUEST FULL TECHDOC ›

Review, verify & provide feedback on the data used to determine QualityScore.

VISIT DATA VERIFICATION ›

ONLINE LIBRARY OF INVESTOR ESG POLICIES

Use the only aggregated library of institutional investor ESG policies to better understand how firms use environmental and social disclosures to make voting decisions. Save time by using a tool that pulls policies into one place so you don’t have to research them one-by-one.

50 largest investment firms included

Searchable by firm, keywords, and topic

Link directly to firm policies from the ISS-Corporate website

ESG PROPOSAL BRIEFS

Since 2012, the number of climate change proposals has increased from 1 to 24 and the average support for those proposals has increased by 13 percentage points.

The ISS-Corporate catalogue of 2017 environmental and social proposals allows companies to review short proposal briefs and familiarize themselves with the most popular shareholder proposals.

SEE AN OVERVIEW OF:

- The proposal itself

- Shareholder responses/rationale

- Management responses

- Highlights from company disclosures

- Shareholder voting history on each proposal

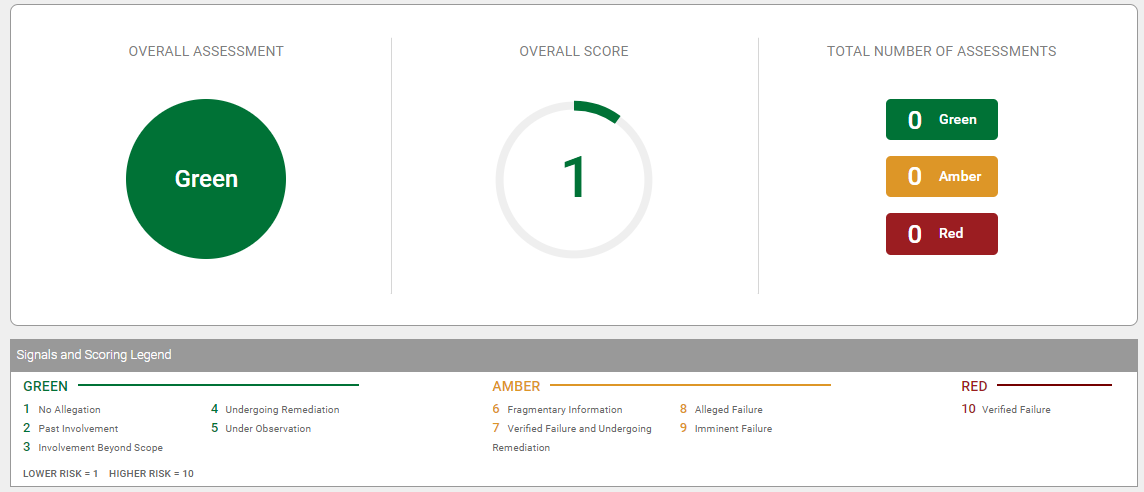

NORM-BASED RESEARCH REPORTS

- Overall assessment results and signals, categorized by degree of verification, severity of impact & company responsiveness

- Proven methodology, continuous innovation

- Broad coverage – 24,000+ equity & debt issuers

- Assesses actual performance in situations where companies face specific risks & challenges

- Provides qualitative insights into company response to controversies through a dialogue-driven analysis

- Extensive company & stakeholder dialogue and strict verification ensures objectivity & exhaustiveness

- Focus on company responsiveness ensures solidity of findings & provides for a forward-looking approach

ADVISORY SERVICES

Stay ahead of investor demands with trusted guidance from ISS-Corporate experts. We save you time by evaluating and auditing your sustainability policies and proposals, analyzing your shareholders’ preferences, and relating best practices from other companies.

ADVISORS ARE AVAILABLE TO

- Deliver insight into what institutional investors are looking for

- Help prioritize opportunities

- Share examples of best-in-class disclosures

- Provide proactive sustainability benchmarking

- Navigate the ISS Environmental & Social data for you, and create custom reports

- Advisory Services are provided as part of an annual subscription, helping you to reduce your spend with project-based consultants

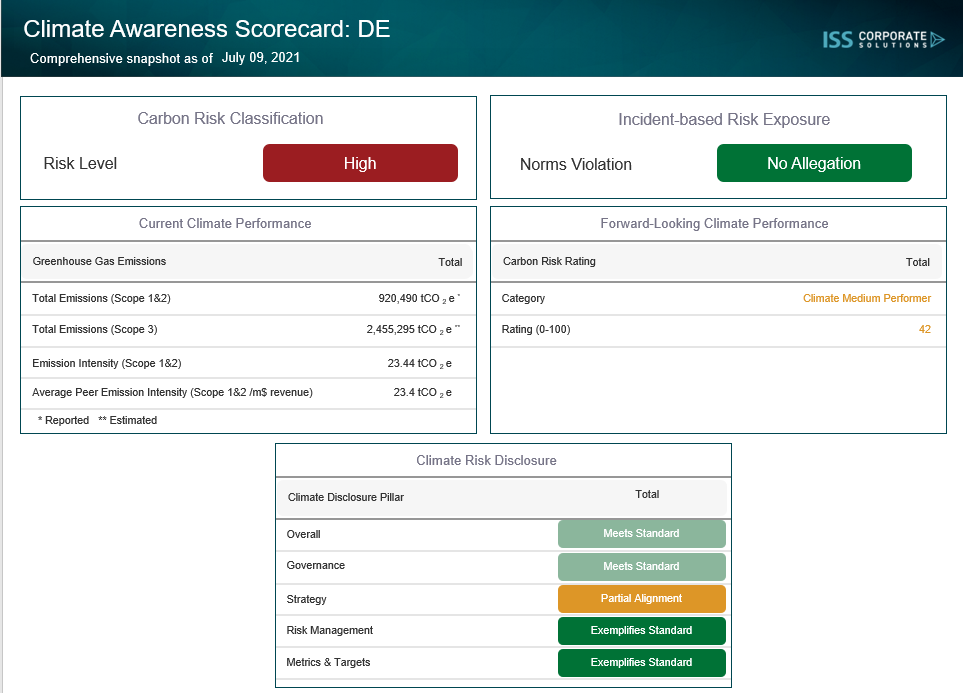

CLIMATE ANALYTICS

The ISS-Corporate Climate Analytics application offers unprecedented data and analytics on the climate-related disclosures and performance of thousands of corporate issuers across the globe.

Perform robust custom analytics and generate executive-ready climate performance and peer benchmarking reports on demand, including:

- The Climate Awareness Scorecard one-page summary

- TCFD Alignment benchmarking

- Greenhouse Gas (GHG) disclosure transparency and emissions benchmarking