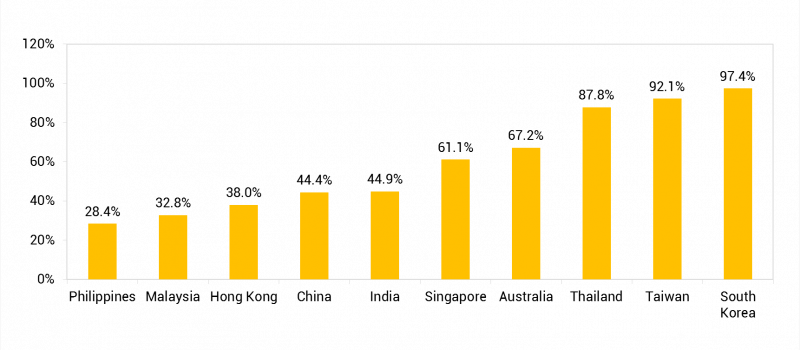

Meeting Concentration

AGMs remain heavily clustered in Asia, limiting shareholders’ ability to both attend meetings in-person and effectively gauge the fairness of the proposals to be voted at the AGMs. Companies tend to hold their AGMs towards the tail-end of the prescribed timeframe. For example, companies in Korea, Singapore, and Taiwan are allowed three, four, and six months respectively, after the end of the financial year to hold their AGMs. Correspondingly, their AGM clustering each peaks in March, April, and June.

Concentration of AGMs held in peak months

In Taiwan, clustering marginally improved YoY, as the percentage of AGMs held in June is dropped from 92.83% in 2015 to 90.92% in 2016. A contributing factor to clustering is competition amongst companies to hold AGMs on the ‘auspicious days’ in June. These dates are typically fully-registered within an hour after the release of AGM registration in early January. As such, the number of companies holding their meetings on those June auspicious days could be as high as 70% Taiwan listed companies.

In an effort to mitigate such heavy clustering, the regulators reduced the daily allowance to a maximum of 100 meetings per day from 120. However, if companies have more than half of their votes casted from the e-voting platform and have adopted the nomination system, they can be exempt from the daily quota restriction and hold the meeting on a day of their choosing irrespective of the quota.

While regulation may have a role in discouraging clustering, large corporations with a broad shareholder base ought to consider taking the lead to hold their AGMs prior to the heavy season in June, in order to fully utilize the AGM as the platform for company-investor communication and to boost investor confidence.

The 2016 Proxy Season So Far

As we have approached mid-2016, most Asia markets except for India and Australia have concluded their annual general meeting (AGM) season. ISS Corporate Solutions (ICS) would like to share with you the observations and insights we have drawn from the data collected from this past proxy season, to give you a more comprehensive view of the corporate governance landscape in the region.